Subscriptions are just the start. Do more with payment volumes through embedded wallets.

Powering unique experiences for top-tier platforms

From subscription to payout

Simplify complex money movements with wallet-based payments.

Issue user and platform wallets

Streamline financial operations with embedded wallets for your users and your back office.

Go multicurrency, stay margin-positive

Configure and manage transfers, conversions, disbursements, and fund reconciliation with accuracy and compliance.

Leverage escrow and conditional flows

Configure wallet-based escrow to hold funds until service completion, dispute resolution, or milestone triggers.

Payment experiences, built your way

Leverage our infrastructure's flexibility to mirror any experience your business model needs.

- Online travel

- Accommodation

- Rental

- Experience

Streamline payments and financial operations in your platform.

Create as many payment splits as you need.

Split payments between as many recipients as you need. Reduce manual effort by automating it from end-to-end.

Accept subscription payments.

Offer membership subscriptions as a new revenue model with our support for recurring payments through cards and direct debit.

Reduce cross-border transaction costs.

Leverage our bank-beating exchange rates and the flexibility to build to save cost on cross-border transaction fees.

Consolidate payments into a single ecosystem and automate everything.

Improve payments agility with e-wallets and secure tokenization.

Retain more users through gamified experiences. Reduce cost with our cost-effective solutions.

Win back time and revenue

207M207M

Wallets created

€68B€68B

transactions processed

9%9%

of payments re-spent

34%34%

less hours spent on operations

Learn how we transformed these platforms

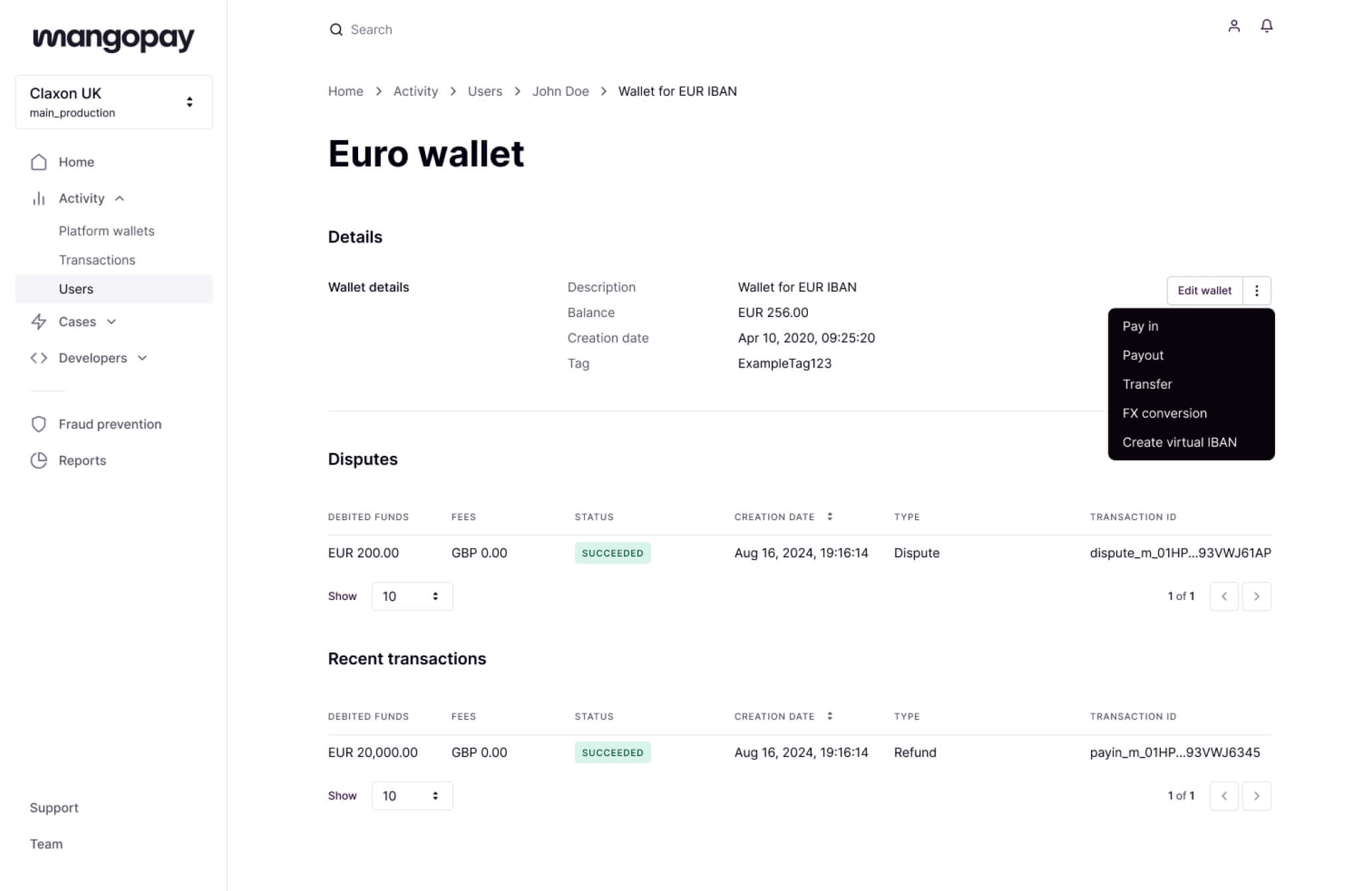

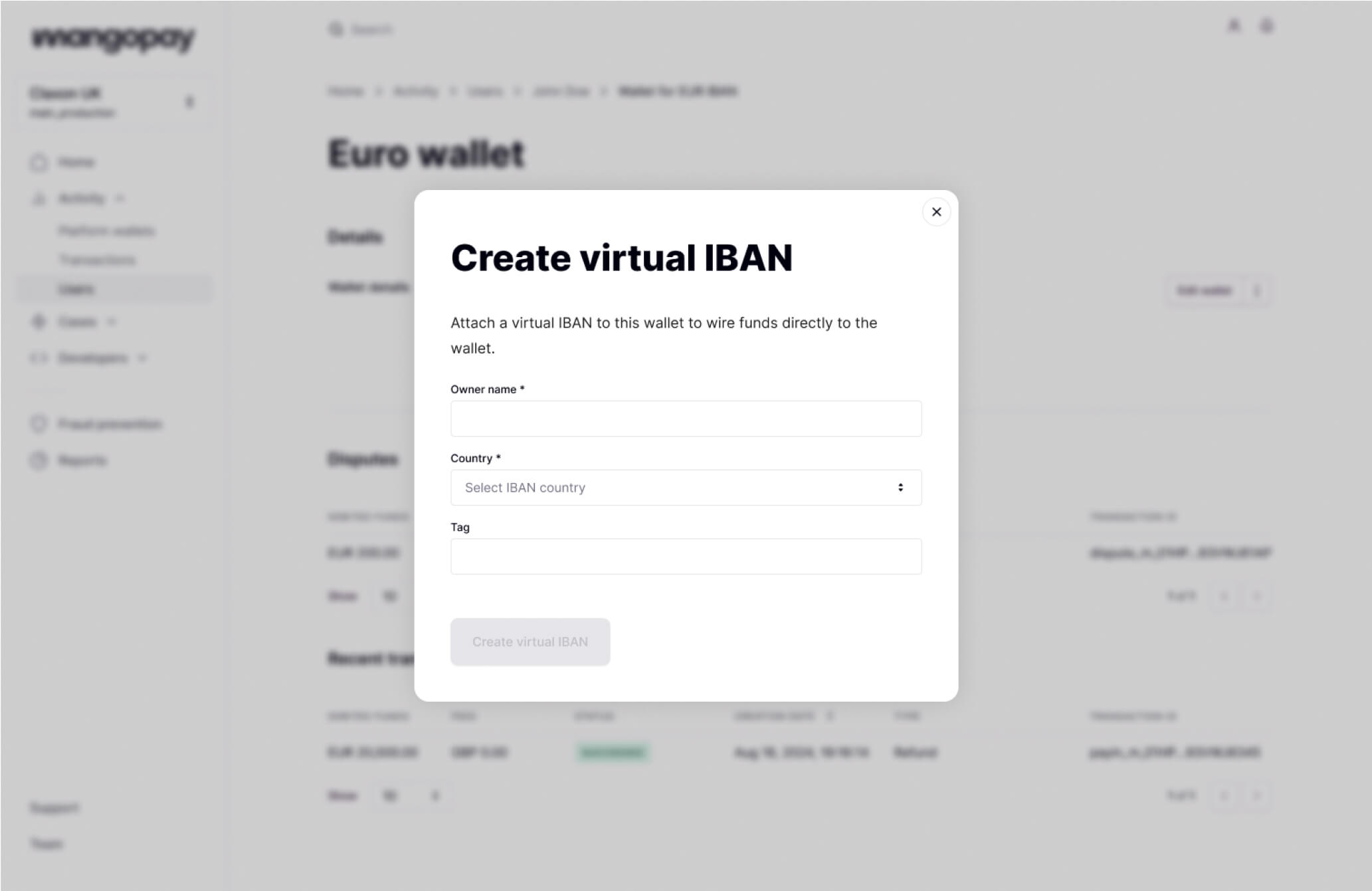

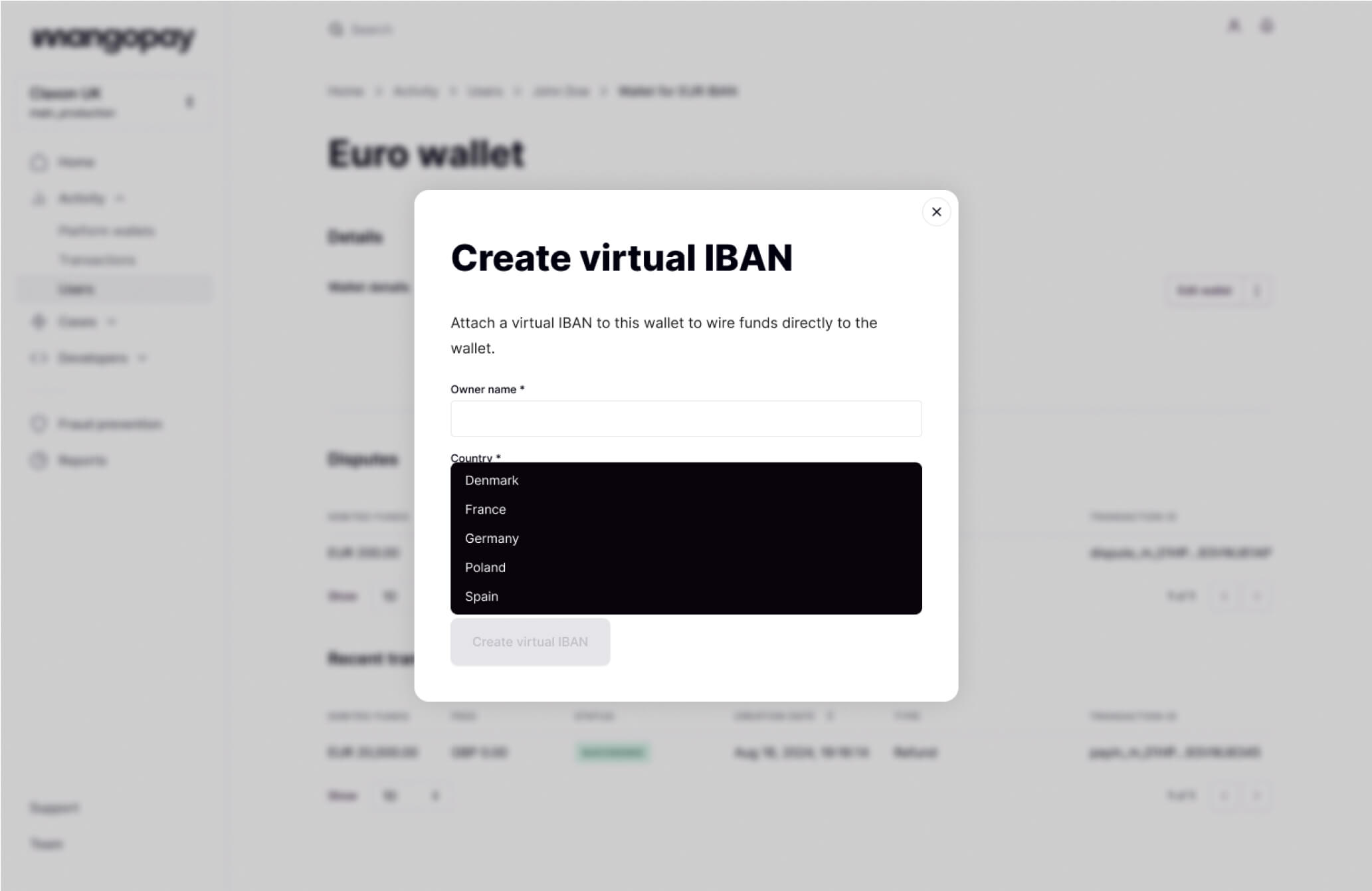

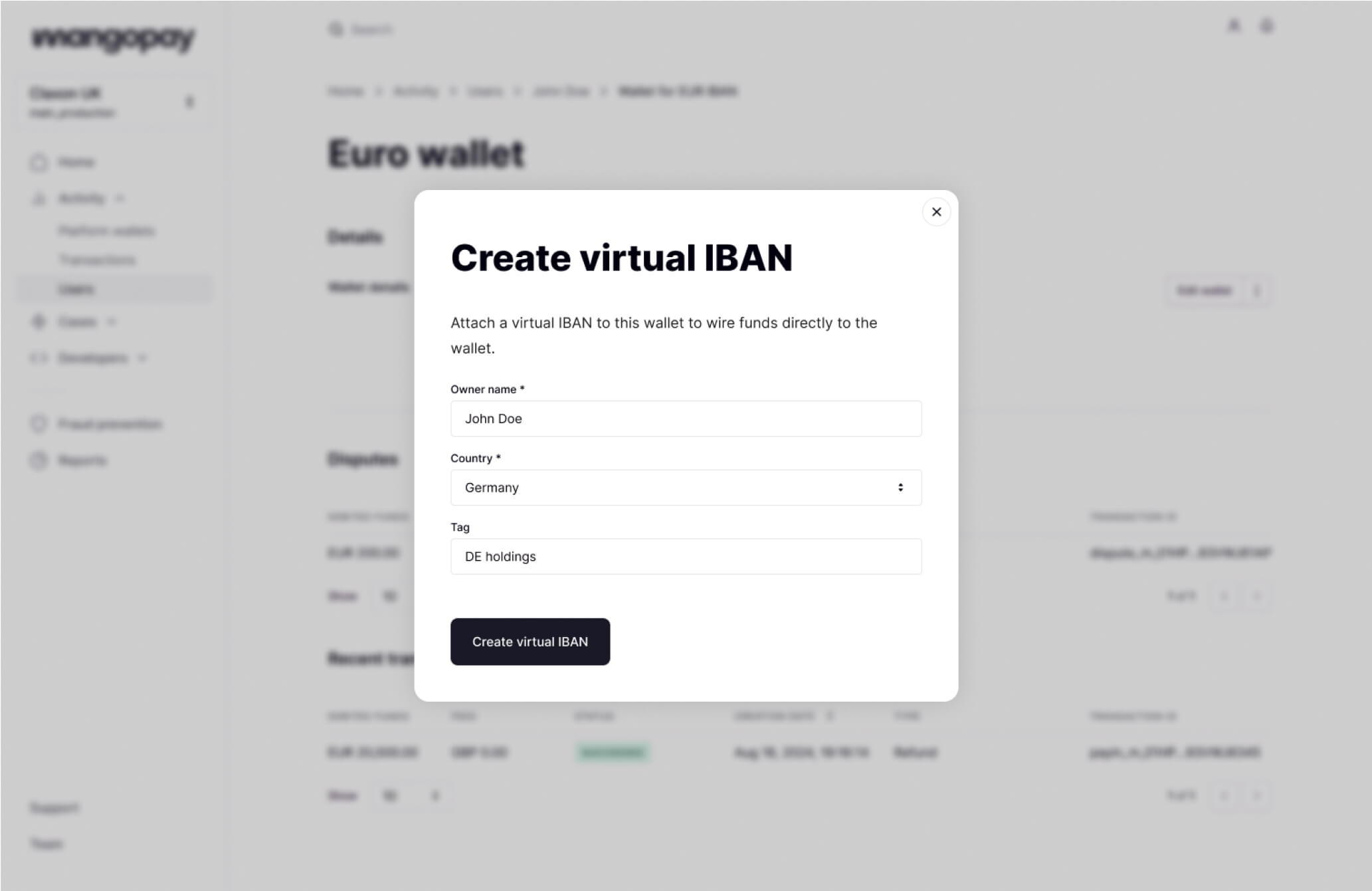

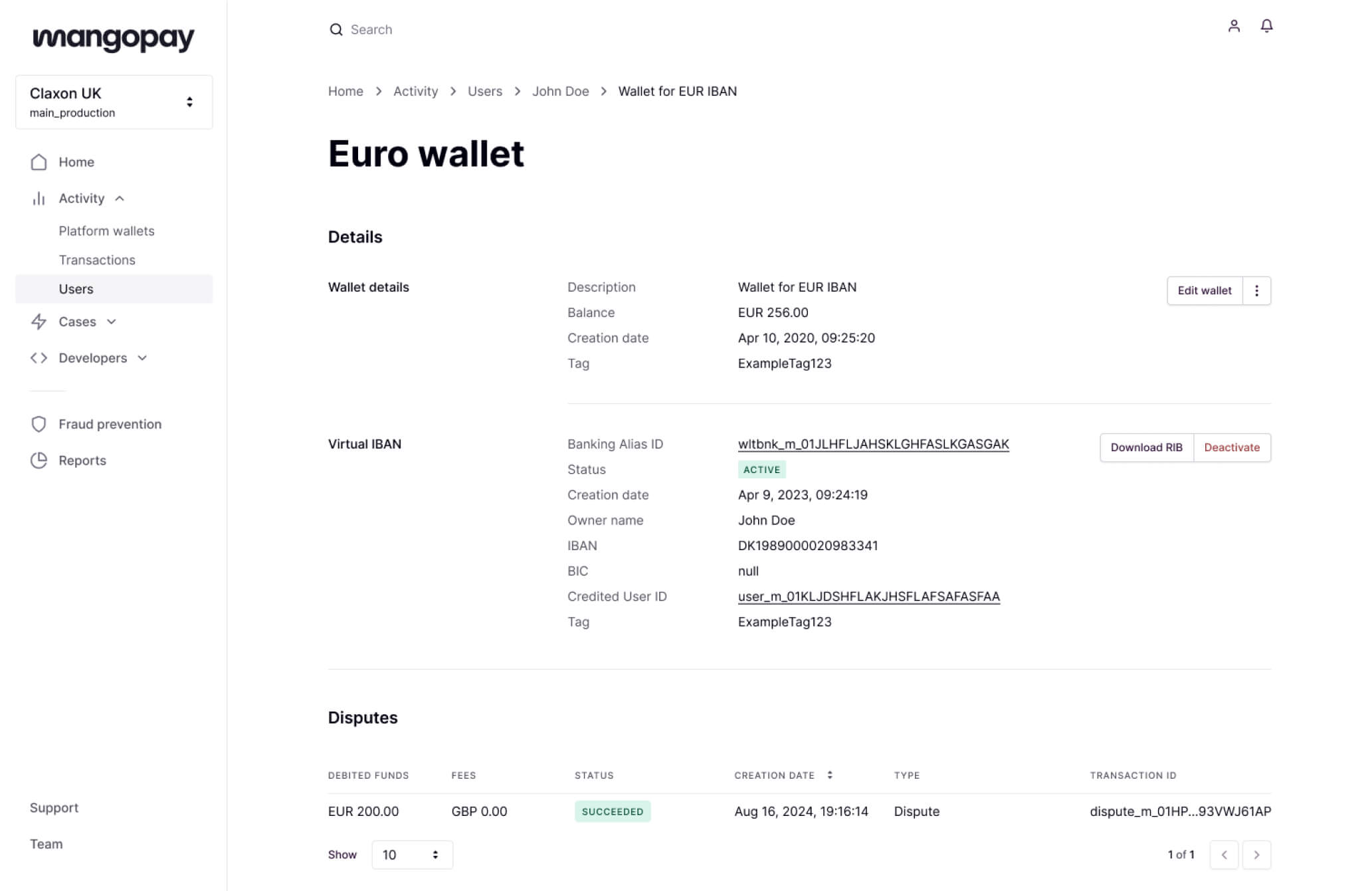

Create and manage all accounts in a single dashboard

Manage all users and transactions in a unified payment ops dashboard.

Ready to start?

Select and connect the products you need to succeed.